The Hidden Risks of Credit Card Cloning: How to Protect Your Business

In today's digital age, businesses are continuously confronted with various security challenges. Among these, the phenomenon of credit cards cloned poses a significant risk. Understanding how this crime operates and the impact it has on your business is crucial for safeguarding your finances.

What is Credit Card Cloning?

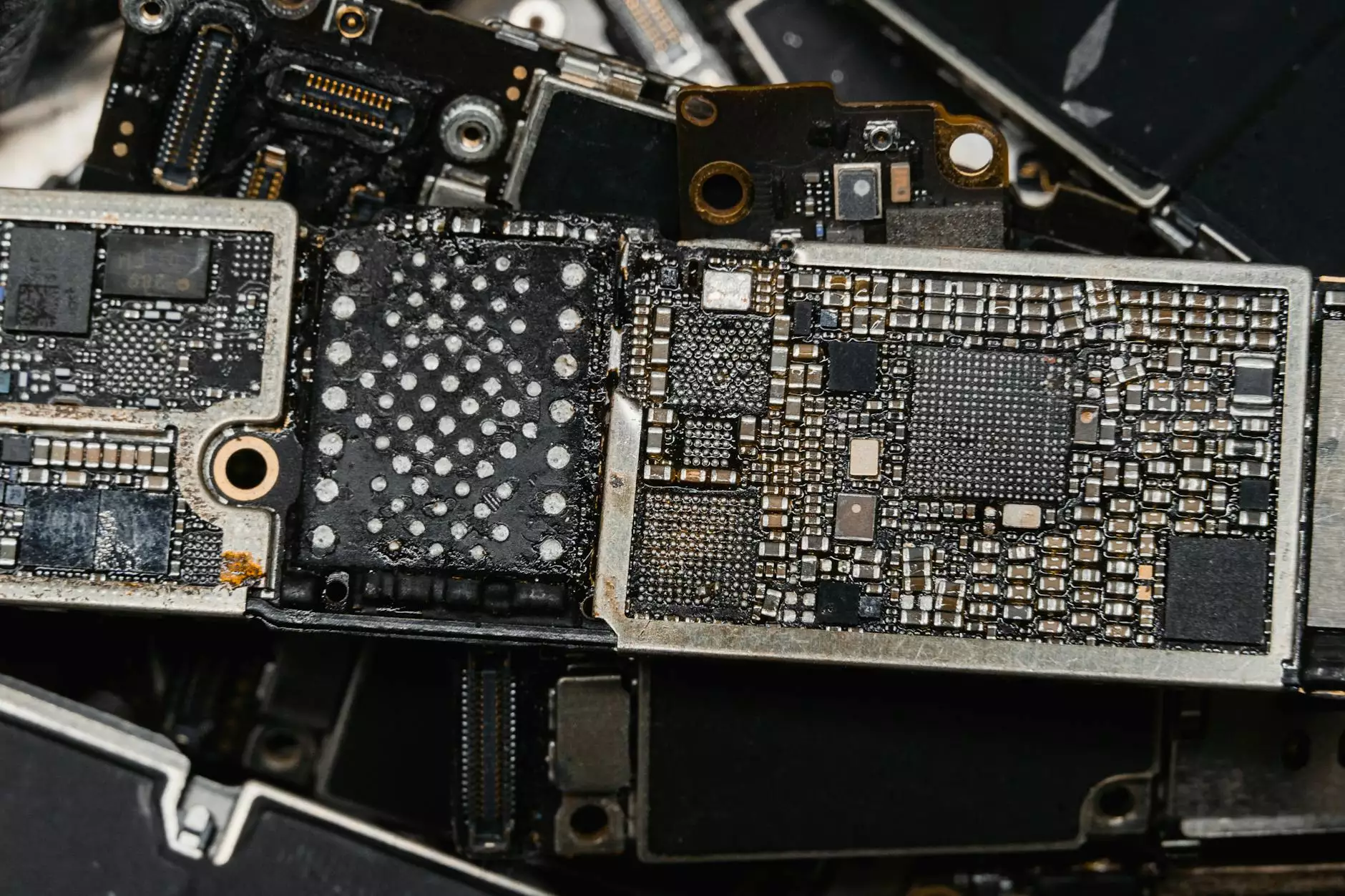

Credit card cloning involves illegally copying the information contained on a credit card's magnetic strip or chip. This process is often achieved through devices known as skimmers, which can capture card details when a consumer makes a legitimate transaction.

How Does the Cloning Process Work?

The process of credit cards cloned typically follows these steps:

- Installation of Skimmers: Criminals install small devices on ATMs or point-of-sale systems to capture data.

- Data Theft: When a card is swiped or inserted, the skimmer records the card's information.

- Card Duplication: The stolen data is then used to create a duplicate card, which can be used for unauthorized purchases.

Impact of Credit Card Cloning on Businesses

The implications of credit cards cloned incidents extend beyond individual victimization—businesses suffer significantly as well. Here are a few ways credit card cloning impacts business:

- Financial Losses: Unauthorized transactions can result in substantial financial damage.

- Reputation Damage: Customers may lose trust in businesses that have experienced data breaches.

- Increased Fraud Losses: Merchants bear the cost of fraudulent chargebacks, leading to increased operational losses.

- Legal Consequences: Businesses may face legal penalties if they are deemed negligent in protecting cardholder data.

Preventing Credit Card Cloning: Essential Strategies

There are effective strategies that businesses can implement to mitigate the risk of credit cards cloned incidents:

1. Implement Security Measures

Installing advanced security systems at points of sale helps detect suspicious activities:

- Modern POS Systems: Upgrading to EMV (Europay, MasterCard, and Visa) technology can significantly reduce fraud.

- Regular Audits: Conducting frequent audits of hardware can help identify unauthorized devices.

2. Educate Employees and Customers

Awareness is the first line of defense:

- Training Programs: Regularly educate staff about security protocols and how to spot skimming devices.

- Customer Information: Provide guidance to customers on how to protect their card data.

3. Monitor Transactions Closely

Keeping an eye on transaction patterns can help businesses spot fraud early:

- Fraud Detection Software: Invest in software that monitors transactions for unusual activity.

- Transaction Alerts: Set up alerts for large or irregular transactions to quickly identify potential fraud.

Case Studies: The Consequences of Credit Card Cloning

Several businesses have faced dire consequences due to credit cards cloned incidents. Here are some notable examples:

Case Study 1: Retail Store Chain

A prominent retail chain suffered a massive data breach where skimmers were discovered on their payment terminals. The result was:

- Loss of over $1 million in fraudulent charges.

- Significant legal fees and settlements with affected customers.

- Long-term damage to brand reputation and loss of customer trust.

Case Study 2: E-commerce Company

An online retailer faced issues when cloned credits cards were used to make fake purchases. This led to:

- Thousands in chargeback fees.

- Decreased merchant account ratings, which affected future payment processing capabilities.

Technological Advancements in Fraud Prevention

With the rise of technology, new solutions are being developed to combat credit cards cloned issues:

- Chip and PIN Technology: This has become a standard in securing a card against cloning, decreasing the chance of fraudulent transactions.

- Contactless Payments: While convenient, these transactions also need robust security measures to protect consumer data.

- AI and Machine Learning: Many financial institutions are now utilizing AI to detect anomalies in credit card usage.

Conclusion

The threat of credit cards cloned is real and permeates through various aspects of business operations. By adopting comprehensive security measures, constantly monitoring transactions, and fostering a culture of awareness, businesses can significantly reduce their vulnerability to credit card fraud. Moreover, as technology evolves, so too do the strategies to combat clonage, necessitating consistent updates in policies and systems to maintain robust security.

Protecting your business from the dangers of credit card cloning not only ensures financial stability but also preserves your reputation in the marketplace. Remember, a proactive approach is always better than a reactive one when it comes to fraud prevention.

For businesses looking to secure their operations against threats, staying informed about scams and best practices in preventing fraud is paramount.